Blog

Here you will find articles on exciting topics from the fields of compliance, law and cyber security.

Please note that the articles, unless otherwise described, are based primarily on the jurisdiction in Germany.

Labour law framework on the topic of ‘workation’ part 3

In order to make working from abroad possible, there is the option of a secondment. This is linked to an A1 certificate and what this involves is explained in the new blog post.

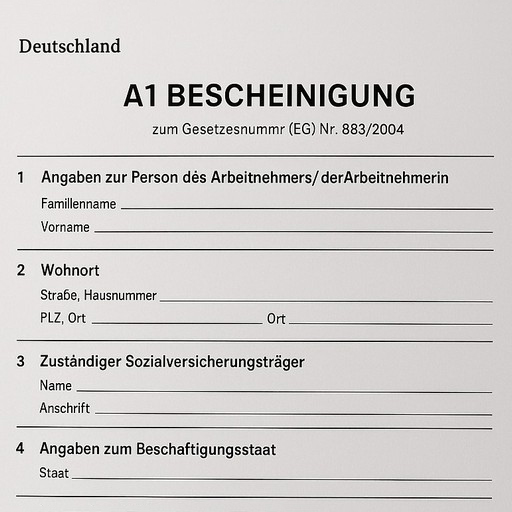

What is an A1 certificate?

An A1 certificate proves whether the social security law of the sending state or that of the foreign state applies to a person in gainful employment who is temporarily staying in an EU state other than their own.

Good to know:

Iceland, Liechtenstein, Norway, Switzerland, Northern Ireland and the United Kingdom include the A1 certificate.

The relevant factor here is that the person in gainful employment is only staying temporarily in another member state. This is referred to as a posting. An A1 certificate from Germany documents that the person working abroad is still subject to German social security law.

The A1 certificate has the advantage that switching between different social security systems or simultaneous contribution payments in several member states can be avoided.

Good to know:

If you work in several member states, you also need the A1 certificate.

Who needs an A1 certificate?

- Employees, civil servants and self-employed persons

- for temporary, cross-border activities

- within the EU

- Regular activity

- Personal scope of application must be fulfilled

What is the personal scope of application?

The personal scope of application is to be equated with the personal requirements that must be met for the posting.

The personal scope of application is fulfilled if the nationality of the person concerned authorises posting to the intended country of employment.

EU nationality always authorises posting to another EU member state.

Good to know:

There is no basis in EU law for persons with other nationalities outside the EU (e.g. Norway).

How do I apply for the A1 certificate?

Employees:

- Electronically

- Via SV-Meldeportal or existing payroll accounting software

- By stating the insurance number of the person to be posted

- By the employer

Self-employed persons:

- Application is made by yourself

- via the SV reporting portal

Good to know:

The group of self-employed persons also includes partners, managing directors and similar persons who are integrated into a company and have the status of self-employed persons under social security law.

Good to know:

A paper application will be inadmissible from 1 January 2025.

written by Carolin Wagner

July 08, 2025

Would you like to organize your workation in a legally compliant manner?

We provide you with comprehensive support and advice on all labor law and social security law issues relating to cross-border work.

Contact us now for a no-obligation consultation!

Labour law framework on the topic of ‘workation’ part 2

The last blog post dealt with the topics of company agreements, occupational health and safety and working hours. This issue deals with data protection law, tax law and social security aspects.

Data privacy

- the responsibility for compliance with data protection remains with the employer

- Compliance with the technical and organizational measures

Good to know:

Data processing in the EU is unproblematic if the technical and organizational standards are complied with. However, these are beyond the control of the employer. It is therefore advisable to develop a guideline in advance on how this can be guaranteed.

A case-by-case assessment is recommended for third countries.

Tax law

Assigning employees abroad also entails tax risks. If the assignment abroad exceeds a certain duration, for example, income tax must be paid in the country of employment. Employers must take care of this.

Tax law has a clear guideline for working from home in other EU countries:

- Absence of the employee does not exceed 183 days

- Employer not domiciled abroad and no local permanent establishment

- Compliance with double taxation agreements within the EU

- Place of residence remains Germany

Social security aspects

Since 2021, mobile work has been legally equivalent to work in a “traditional” workplace.

The frequent “mixing” of private and professional activities is problematic.

Key question: Is the specific behavior that led to the accident more likely to be classified as professional or private? Depending on this, statutory accident insurance may or may not apply.

Good to know:

When work-related and private activities intermingle, as is typical in mobile work, risks and gaps in protection arise that cannot yet be calculated with certainty due to the still “young” legal situation and the lack of established case law. One possible solution could be private accident insurance.

written by Carolin Wagner

June 02, 2025

Workation without legal pitfalls? We make it possible!

Whether data protection, tax law or social security - we provide comprehensive advice on all legal aspects relating to workation and mobile working abroad.

Minimize risks, create clarity for your company and your employees.

Contact us now for a no-obligation consultation!

Labour law framework on the topic of ‘workation’ part 1

Summer is just around the corner and many employees want to work from a different place in the world. In an increasingly digital and flexible working world, the concept of workation - a combination of work and holiday - is becoming more and more important. This gives employees the opportunity to carry out their professional activities from abroad while enjoying the benefits of a holiday environment. How companies can realise this is explained in the current blog series on the topic of ‘Workation’.

This edition focuses on the topics of company agreements, health and safety and working time:

Despite the obvious benefits, however, workation raises several legal issues. Employers and employees must ensure that legal requirements are adhered to avoid legal risks.

Good to know:

There are currently no legal regulations regarding the flexibilization of the place of work. In order to offer flexible working models, it is advisable to include these in employment contracts or works agreements.

What components should a works agreement have in this regard?

- Which employees can work mobile / use a workstation - which cannot?

- Agreements regarding working hours and availability (it is essential to take into account different time zones)

- Liability issues in the event of accidents and illness

- Limiting the duration and frequency of use of mobile working / workation

- Cancellation options

Occupational health and safety and mobile working - potential hazards of mobile working

Possible hazards and restrictions:

- Impairment due to unfavourable ergonomic working conditions (suitable office chair, lighting)

- Suitable conditions for VDU work (screen quality and size)

- Exposure to disturbing external influences (noise, air quality, temperature)

- Stress due to lack of communicative exchange with team members

- Lack of social connection to company events

- Mental stress due to time pressure, availability and insufficient recovery time

But how can the health and safety of employees be guaranteed and based on which legal standards?

- Provision of safe work equipment in accordance with Section 618 BGB

- Instruction of employees in accordance with § 12 ArbSchG

- Carrying out a risk assessment in accordance with 5 ArbSchG

Potential challenges:

Possibility of influencing work circumstances?

Possibility of enforcing instructions?

Working hours

A well-thought-out concept is required for compliance with working time regulations that takes into account the essential framework conditions. This could include working in different time zones. But how can this be mapped?

- Implementation by means of technical and organisational measures (adjustment of meeting times)

- Agreement on a written instruction

Good to know:

The Working Hours Act applies exclusively in the Federal Republic of Germany.

Basic regulations:

Maximum working hours:

8 hours per working day

10 hours a day

Rest breaks:

30 minutes after 6 hours

45 minutes after 9 hours

Rest periods:

11 hours between shifts and working days

Good to know:

Ban on working on Sundays and public holidays - with exceptions for specific areas

The other legal aspects of ‘workation’ will be explained in the next issue of the blog.

written by Carolin Wagner

May 02, 2025

Designing a professional and legally compliant workation? We can support you!

Whether it's a company agreement, occupational health and safety or working time regulations: we help you to create clear structures and legally compliant regulations for mobile working from abroad - individually, practically and tailored to your company.

Contact us now for a no-obligation consultation!

Amount of severance pay

The termination of an employment raises the question of a possible severance payment for many employees. But how much is a severance payment? While last month's blog entry explained the possible bases for claims relating to severance pay, this month's post focuses on the amount of potential severance pay. This article highlights the most important aspects of calculating the amount of severance pay and provides an overview of common calculation formulas and negotiation options.

The amount of the severance payment is based on the following three points:

- half a gross monthly salary per year of employment

- the duration of the employment (rounded up to one year after six months)

- the last monthly salary of the existing employment

Although this requirement for severance pay only applies in the event of dismissal for operational reasons, it is often used as a starting formula for termination agreements. However, the amount of the severance payment in detail is always a matter for negotiation and depends on the chances of winning an action for unfair dismissal.

Socially unjustified dismissal

If the dismissal is socially unjustified, there is an alternative to reinstatement:

- According to § 9 KSchG, the court must determine that the dismissal is socially unjustified

- Continued employment is not reasonable for the employee

At the employee's request, the court can then terminate the employment relationship in return for a severance payment.

- The amount of the severance payment is up to twelve months' salary in accordance with § 10 Abs. 1 KSchG

- The monthly salary is calculated as the value to which the employee is entitled in the month in which the employment relationship ends, including all benefits in cash and in kind

Good to know:

Different amounts apply for employees who have reached the age of 50 in conjunction with a certain length of service in accordance with § 10 Abs. 2 KSchG:

50 years of age and at least 15 years of service = 15 months' salary

55 years of age and at least 20 years of service = 18 months' salary

Tax and unemployment benefit entitlement

Good to know:

For tax purposes, severance payments are considered extraordinary income and are subject to income tax. However, they are not subject to social security contributions. In order to avoid an excessive tax burden, the so-called fifth rule could be applied until 2024. This rule spreads the tax burden arithmetically over five years and thus mitigates the progressive effect of income tax.

From 2025, however, the procedure will change so that employers will be relieved. They will no longer have to carry out the complex calculation of the one-fifth rule. For employees, this means that the severance payment will be fully taxed as wages in the month of payment. The tax relief provided by the one-fifth rule can be claimed retrospectively by submitting an income tax return.

Für die Arbeitnehmenden bedeutet dies, dass die Abfindung im Monat der Auszahlung voll als Arbeitslohn versteuert wird. Die steuerliche Erleichterung durch die Fünftelregelung kann nachträglich durch die Abgabe einer Einkommensteuererklärung geltend gemacht werden.

Good to know:

A severance payment can affect unemployment benefit entitlement. For example, if the notice period was not observed. There does not have to be a blocking period. In this case, employees do not receive any wage replacement benefit until the employer's notice period has expired. For a maximum of one year and only until the severance pay is deemed to have been used up.

written by Carolin Wagner

April 04, 2025

Severance pay - fair, legally compliant and well regulated? We can help you with this!

Whether termination for operational reasons, a termination agreement or a court settlement: We provide you with comprehensive advice on the legally compliant structuring of severance payments, accompany negotiations and clarify tax and social security issues - so that you as an employer are on the safe side.

Contact us now for a no-obligation consultation!

Severance pay - when are employees entitled to it?

In employment law practice, the question often arises as to the circumstances under which an employee is entitled to severance pay. Contrary to popular belief, there is no automatic statutory entitlement to severance pay on termination of employment. Rather, such claims arise from specific situations or are reached as part of court settlements.

It is important to know that anyone who has worked for more than six months in a company with more than ten employees benefits from protection against dismissal under the KSchG. This means that an ordinary dismissal - also known as a dismissal with notice - can be reviewed in court.

Scenarios worth considering:

1. Severance pay solution pursuant to § 1a KSchG

Employers must make a conscious decision to offer severance pay in accordance with Section 1a KSchG and preferably offer it in the notice of termination. The prerequisites for this are

- The KSchG must be applicable, which means that the dismissed employee must have worked for more than six months in a company that employs more than ten employees

- The employer must have given notice of termination for operational reasons. In the case of employees who cannot be dismissed with notice, this can also be an extraordinary dismissal for operational reasons with the granting of an expiry period

- The letter of dismissal must state that the dismissal is based on urgent operational requirements and that the employee can receive a severance payment in accordance with Section 1a KSchG if he or she does not make use of the statutory period for taking legal action (against the dismissal)

- The dismissed employee must allow the statutory period of three weeks to lapse unused in accordance with Section 4 sentence 1 KSchG, so that the dismissal becomes legally effective

Good to know: § Section 1a KSchG does not contain a general or even mandatory statutory entitlement to severance pay.

2. Socially unjustified dismissal and unreasonableness of the continuation of the employment relationship

A statutory entitlement to severance pay arises from §§ 9 and 10 KSchG. The following requirements must be met:

- Filing an action for protection against dismissal within three weeks of receipt of the dismissal by the employer

- Determination by the labor court that the dismissal is socially unjustified and the employment relationship is therefore not terminated

- Determination of the unreasonableness of continuing the employment relationship, or determination that it is no longer to be expected that further cooperation in the interests of the company can take place

Good to know: Unreasonableness is to be assumed if the employee would be entitled to terminate without notice. Reasons that do not justify termination without notice can nevertheless make continuation unreasonable. For example, cases in which inaccurate defamatory allegations about the employee have been carelessly noted as grounds for termination or the relationship of trust has been destroyed in the course of the process through no significant fault of the employee. In such cases, the employment relationship is terminated by the court in return for a severance payment to the employee.

3. Contractual compensation claims

In addition to the options mentioned above, there is also the option of contractually agreeing a severance payment between the employee and employer. The best-known form is the termination agreement, which leads to the amicable termination of the employment relationship. It is important to note that the employee's consent to such an agreement can lead to disadvantages in terms of unemployment benefit. Specifically, this means the potential imposition of a suspension period.

written by Carolin Wagner

March 17, 2025

Legally compliant termination - fair negotiations - avoid risks

Whether termination, termination agreement or court proceedings: We support you in structuring severance packages in a strategically clever and legally sound manner. Avoid mistakes, minimize risks and create clarity - for your company and your employees.

Contact us now for a no-obligation consultation!

Contact

Feel free to contact us for a further exchange. We look forward to hearing from you.

info [at] cysole.com